Roi formula property

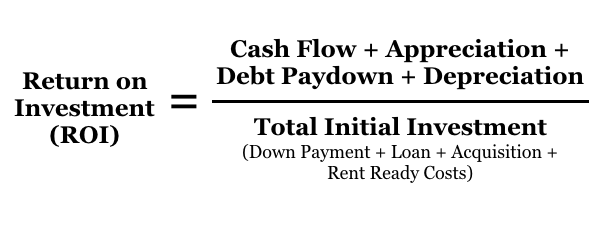

A marketing manager can use the property calculation explained in the example section without accounting for additional costs such as maintenance costs property taxes sales fees stamp duties and legal costs. When it comes time to mind your due diligence or sell a property its a good idea to adjust your net operating income for a less-than-perfect occupancy rate.

How To Calculate Roi On Rental Property Rapid Property Connect

The formula for the estimated future appreciation value looks like this.

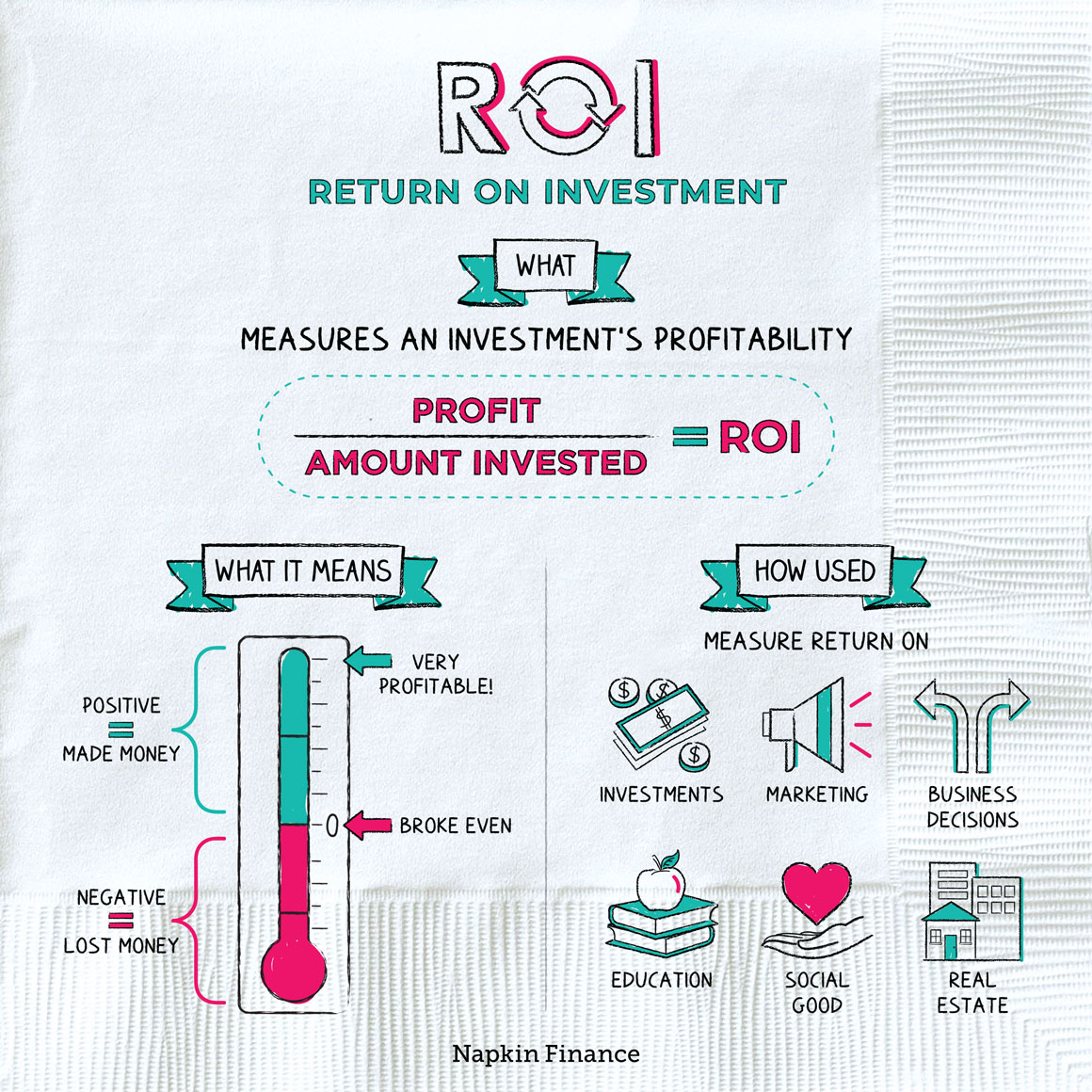

. Return on investment is a ratio that evaluates how efficient a certain investment isIt is the obligatory starting and finishing point for any ambitious investor as it presents the potential of a future deal and the end results of a finished one in simple numbers. We will assume a value of 1400 per month on this property cell D22If you are charging for any other amenities like parking cleaning services landscaping fees etc we will catalog that value as Other Income cell D23. The pro forma CAP rate formula is similar to the CAP rate formula.

The ROI formula is based on two pieces of information - the gain from investment and the cost of investment. How to Calculate ROI. Some properties that were stellar ROI producers several years ago have effectively been legislated out of the rental.

The value per share of PQR Ltd is 700. Your initial ROI calculation in Excel appears as a decimal. Many people have walked away with live deals and joint ventures from the Crash Course so come with super high expectations.

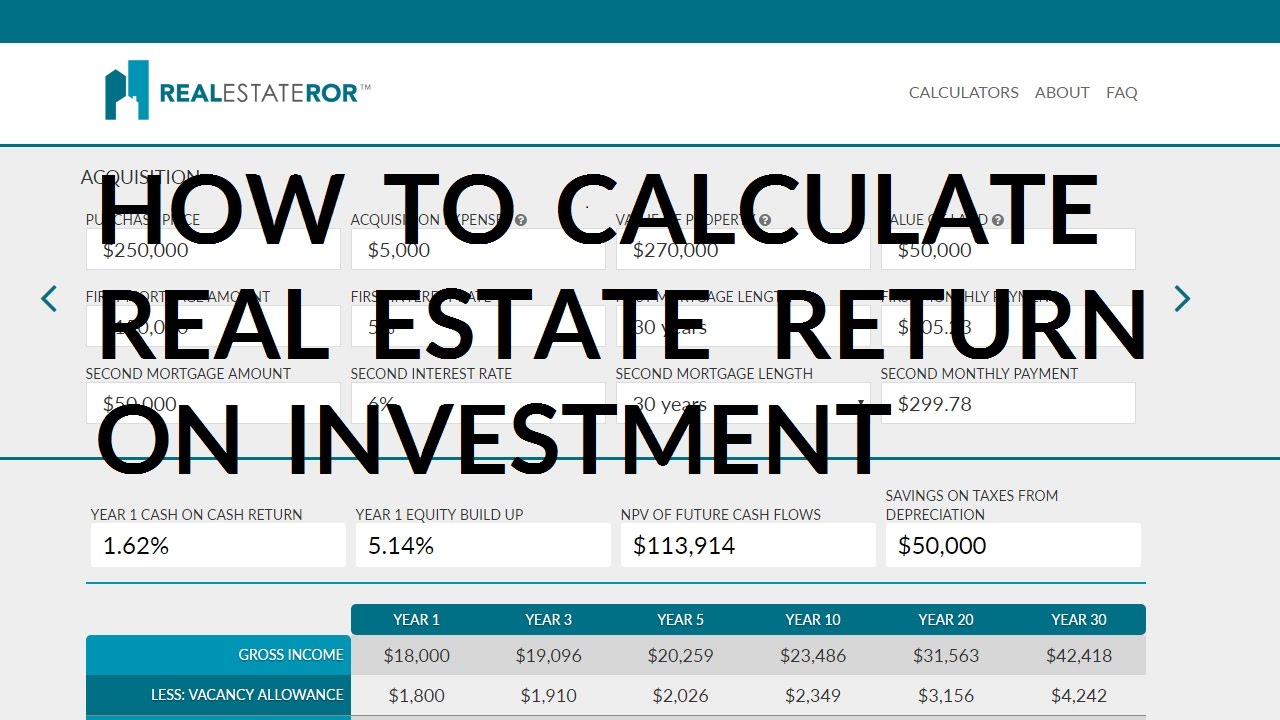

However it assumes a perfect occupancy rate. A large component of the real estate investment spreadsheet is in helping you calculate the buildings CAP rate. This ROI calculator return on investment calculates an annualized rate of return using exact dates.

The basic formula for ROI is. Three years later you sell this property for 900000. So David has earned a return equivalent to 2 times his.

From the beginning until the present he invested a total of 50000 into the project and his total profits to date sum up to 70000. 8000 2000 4. Like calculating the amount of gain or loss use a formula to calculate the ROI in cell D2.

Which formula is needed to see whether this is a profittable investment and. It helps to gauge the ROI made by your own money. June 30 2020 at 629 pm.

The formula for PPE Turnover is simply total revenue from the income statement divided by ending PPE from the balance sheet. How to calculate current appreciation. While the ROI formula itself may be simple the real problem comes from people not understanding how to arrive at the correct definition for cost andor gain or the variability involved.

If you have taken debt and it has helped increase the return then this multiple will increase. I forgot to state that owner will pay the 500K back as well as 40 of the appraised increase in the property value. The monthly revenue will be the cash received each month by renting out the property.

Now for calculation of Total Return and of Total Return the following steps are to be taken. How to calculate ROI Return on Investment Calculating annualized return. Buildings Profit after repairs BI Buildings Purchase Price.

The first step is to buy the property and the immediate second is to implement Lodgifys state-of-the-art vacation rental software. A Guide To Calculating Return on Investment. ROI - Practical Examples ROI Formula.

Pro forma CAP rate formula. Beginners looking for the basics of finding buying updating and renting a property will enjoy Lisa Phillips 2018 comprehensive guide on real estate investment strategies. ROI Gain from Investment - Cost of Investment Cost of Investment As a most basic example Bob wants to calculate the ROI on his sheep farming operation.

52219100000 100 5222. To show this in Excel type C2A2 in cell D2. 70000 - 50000 50000.

Get your ticket to the Property Investors Crash Course for just 1 where you will be shown how you can make a full time income from property even if you are starting with NO MONEY. The equation that allows calculating ROI is as follows. Value of 9 Debentures is 90000.

We will leave this at 0 zero for our example. If we have 8000 in revenue this year and divide that by property plant and equipment investments worth 2000 our PPE Turnover is. This means we generated 4 in sales revenue for every 1 of PPE.

Enter the ROI Formula. Convert the ROI to a Percentage. An ROI calculation will differ between two people depending on what ROI formula is used in the calculation.

First calculate the equity multiple of the property. For instance for a potential real estate property investor A might calculate the ROI involving capital expenditure taxes and insurance while investor. Cap Rate Formula.

Do not forget to include vacancy rates in your Gross Operating Income GOI calculations as this will give a clearer picture of what a property can reasonably return in a year. Pro Forma CAP Rate Formula. Total Return Formula Example 2.

Cap Rate Net Operating Income NOICurrent Market Value CMV. NOI is a mathematical formula used to calculate how profitable a potential investment property is in a single year by subtracting total annual expenses from income. Equity Multiple Formula Present Value of the Property Amount Invested.

10 appreciation rateN number of years appreciation factor Appreciation factorcurrent value appreciation value after N years. To calculate return on investment you should use the ROI formula. The ROI formula divides the amount of gain or loss by the content investment.

Mortgage Amortization Calculator. You purchase a property in New York for 600000. The above formula is great for comparing potential investments analyzing single-family homes and getting a quick overview of a deal.

Roi Formula Calculate Roi And More From Napkin Finance

How To Calculate Roi On Spanish Rental Property Buyer S Agent Spain

How To Calculate Roi For A Potential Real Estate Investment Excelsior Capital

How To Calculate Roi On Spanish Rental Property

Quick Flip Quick Tip Calculating Roi Net Profits In Real Estate Youtube

Calculating Returns For A Rental Property Xelplus Leila Gharani

What Is A Good Return On Investment For Rental Properties Mashvisor

Rental Property Cash On Cash Return Calculator Invest Four More

How To Calculate Roi On Rental Property Rapid Property Connect

4 Ways Passive Investors Can Calculate Roi In Real Estate

Roi In Real Estate How To Calculate Roi On Property 99acres

Return On Equity Denver Investment Real Estate

How Do You Calculate Return On Investment On Rental Property

Calculating Returns For A Rental Property Xelplus Leila Gharani

How To Increase Roi On A Rental Property Mashvisor

4 Ways Passive Investors Can Calculate Roi In Real Estate

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube